The energy story in 2025 is bigger than “oil is up” or “renewables are booming.” Global energy investment is projected to reach a record $3.3 trillion in 2025, with about $2.2 trillion expected to go into clean energy technologies like renewables, grid upgrades, battery storage, and nuclear—compared with roughly $1.1 trillion still headed toward fossil […]

The Shocking Truth About Passive Income (And Why Most People Get It Wrong)

For informational purposes only, not financial advice. Results may vary. Please read our full disclaimer at the end of this article.

Everyone wants to “make money while they sleep.” It’s the dream that fuels books, podcasts, and endless social media gurus preaching about financial freedom. But here’s the truth: passive income isn’t about doing nothing — it’s about setting up systems today that keep working for you tomorrow.

For most people, the term conjures up images of sipping cocktails on the beach while checks roll in. The reality is more strategic — and more powerful. Passive income isn’t instant magic; it’s delayed gratification. You put in the effort upfront, and if you structure it wisely, the rewards multiply long after the work is done.

Think of it like planting a fruit tree. The day you put the seed in the ground, you get nothing. For weeks, maybe months, it looks like wasted effort. But years later, that same tree can feed you endlessly with almost no upkeep. That’s how true passive income works.

The biggest mistake people make? They chase trends. One week it’s crypto, the next it’s dropshipping, then it’s a YouTube channel they abandon after 5 videos. Passive income isn’t built on hype; it’s built on stability. Rental properties, dividend-paying stocks, online assets that bring recurring traffic — these are not glamorous shortcuts, but they are proven vehicles.

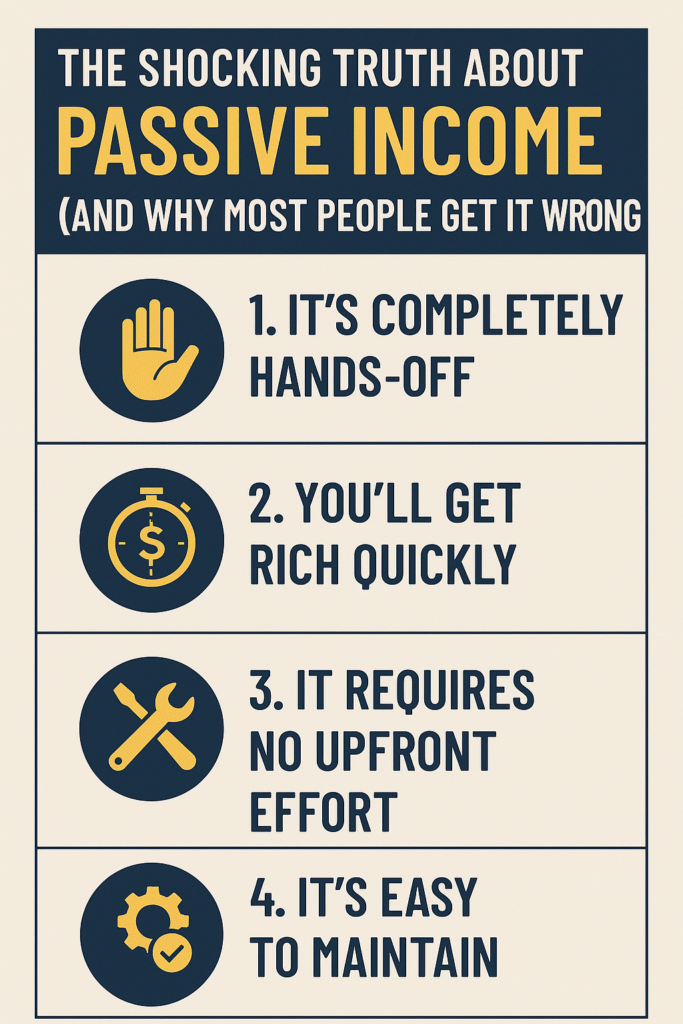

And here’s the part the gurus don’t tell you: most so-called “passive” income streams aren’t 100% passive. Rental properties need management, blogs need fresh content, and investments need monitoring. The goal isn’t zero effort — the goal is disproportionate reward for the effort you put in.

When done right, passive income changes the game. Your salary no longer defines your future. Your time is no longer chained to your paycheck. You stop trading hours for dollars and start leveraging systems that earn while you live your life.

The question isn’t whether passive income works. The real question is: are you willing to do the hard work now so you can enjoy the easy rewards later?

Disclaimer: The information provided on this article is for educational purposes only and should not be considered financial, tax, or legal advice. Always consult with a licensed financial advisor for advice tailored to your financial situation. Results may vary, and ThriveLifeHQ does not guarantee any specific financial outcomes.

Trending Posts On Thrive Life HQ

Top 5 Best US Cities for Retirees in 2025

Retirement is changing fast. The old image of rocking chairs and quiet suburbs is being replaced by active lifestyles, affordable comfort, and access to great healthcare. In 2025, retirees are looking not only for sunshine but also for stability, culture, and connection. Using data on cost of living, healthcare access, housing affordability, and quality of […]

ThriveLifeHQ’s 2025 Holiday Savings Guide

Holiday shopping is bigger, longer, and more digital than ever—which means there are more ways to save if you plan ahead and stack rewards strategically. This guide keeps it simple: practical tactics you can use today, with easy, no-cost tools. 1Cash-Back Apps & Portals You Can Stack Free to Join Start with a cash-back “layer” […]