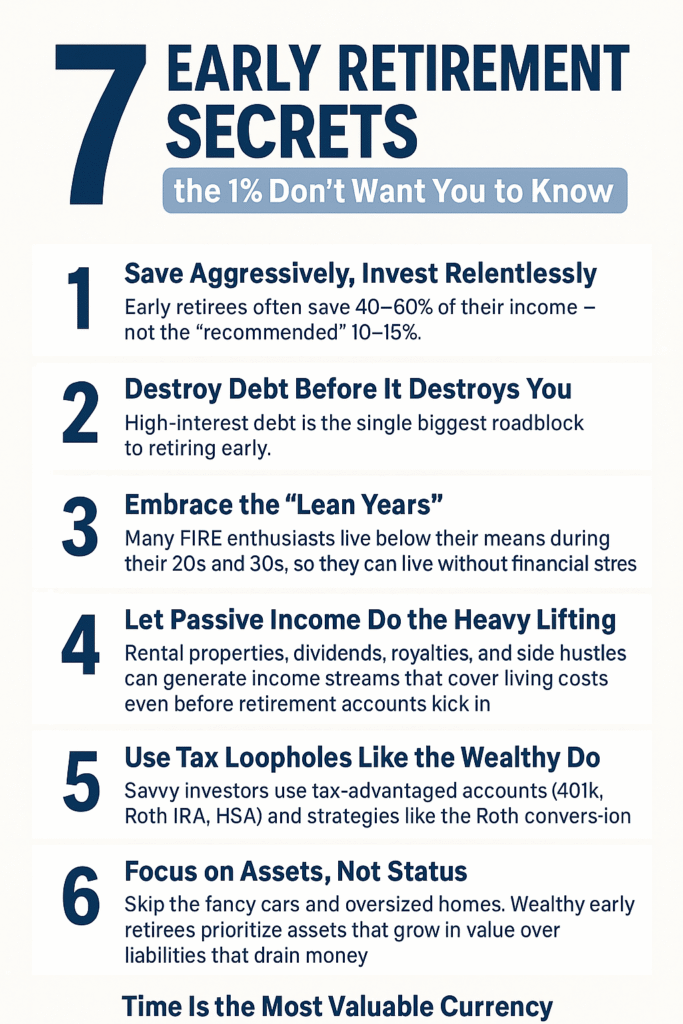

7 Early Retirement Secrets the 1% Don’t Want You to Know (But You Can Start Today)

Retiring in your 40s or 50s sounds impossible — unless you know the strategies wealthy people quietly use to escape the 9-to-5 decades early. The truth is, early retirement isn’t about luck. It’s about smart planning, disciplined saving, and a mindset shift most people never make.

Here are 7 powerful secrets that can put you on the fast track to financial freedom:

1. Save Aggressively, Invest Relentlessly

Early retirees often save 40–60% of their income — not the “recommended” 10–15%. The surplus is invested in stocks, index funds, and real estate to fuel compounding growth.

2. Destroy Debt Before It Destroys You

High-interest debt is the single biggest roadblock to retiring early. Paying it off is like giving yourself a guaranteed return on investment.

3. Embrace the “Lean Years”

Many FIRE (Financial Independence, Retire Early) enthusiasts live below their means during their 20s and 30s, so they can live without financial stress later.

4. Let Passive Income Do the Heavy Lifting

Rental properties, dividends, royalties, and side hustles can generate income streams that cover living costs even before retirement accounts kick in.

5. Use Tax Loopholes Like the Wealthy Do

Savvy investors use tax-advantaged accounts (401k, Roth IRA, HSA) and strategies like the Roth conversion ladder to retire decades early without penalties.

6. Focus on Assets, Not Status

Skip the fancy cars and oversized homes. Wealthy early retirees prioritize assets that grow in value over liabilities that drain money.

7. Time Is the Most Valuable Currency

Every dollar saved and invested in your 20s is worth far more than in your 40s. The earlier you start, the easier early retirement becomes.

✨ Bottom Line: Early retirement isn’t about deprivation. It’s about making smarter financial moves now so your money works for you later. The question isn’t whether it’s possible — it’s whether you’ll start today.