The energy story in 2025 is bigger than “oil is up” or “renewables are booming.” Global energy investment is projected to reach a record $3.3 trillion in 2025, with about $2.2 trillion expected to go into clean energy technologies like renewables, grid upgrades, battery storage, and nuclear—compared with roughly $1.1 trillion still headed toward fossil […]

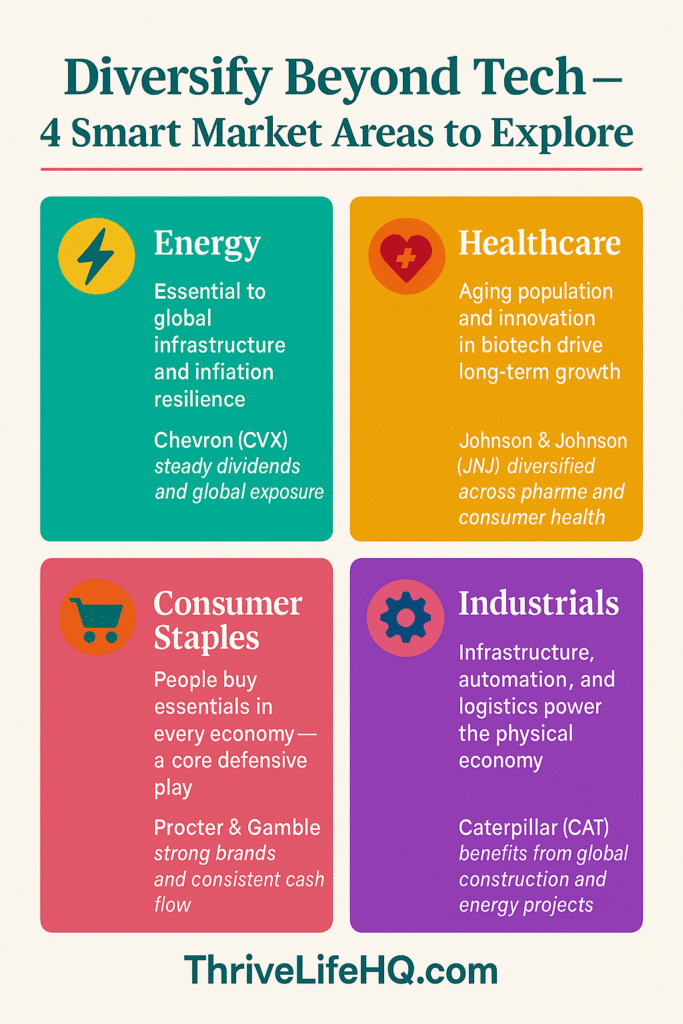

The headline world-changer buzz around artificial intelligence and big-tech stocks is hard to ignore — but smart investors know the market is far broader than just algorithms and chipsets. While tech may dominate headlines, real portfolio strength often comes from balance and diversification across varied sectors. After all, the global economy runs on more than software updates and server farms.

Below we’ll explore four major market sectors that are often overlooked in the “AI and tech only” narrative — and we’ll look at one real-world company example in each, with a brief snapshot of how they’ve performed recently. While nothing is a guarantee in investing, understanding these areas can help build a broader, more resilient portfolio.

⚡️ 1. Energy — powering the global economy

Energy means more than oil wells and gas pipelines; it touches transportation, heating, power generation, and even data-centre cooling. The world doesn’t pause when the internet flutters — it keeps moving because of fuel, infrastructure, and energy delivery.

Example company: Chevron Corporation (CVX)

Chevron has posted a 5-year dividend growth rate of approximately 6.2% per year (as of June 2025) (GuruFocus). Meanwhile, estimates suggest the company returned about 21.4% per year over the last five years. That said, the broader 10-year annualized return is around 9.62% and has lagged the S&P 500 average of ~12.4% over the same period (PortfoliosLab).

Performance evaluation: Chevron may not have competed with the hyper-growth tech giants, but it has delivered steady dividend growth and decent total returns — making it a candidate for investors seeking income plus long-term exposure to energy. The moderate beta (~0.81) suggests somewhat lower volatility versus the market (Finbox).

Sleeper pick: Targa Resources (TRGP)

Why it’s interesting: Midstream operator leveraged to NGLs and export growth; benefits from volume throughput rather than commodity prices.

Recent snapshot: Reported first-quarter 2025 adjusted EBITDA of $1,178.5 million, up ~5% sequentially (Targa Resources press-release) (turn0search23). Considerations: Midstream still faces project/contract risks; cash flows tied to volumes and counterparties.

❤️ 2. Healthcare — innovation meets long-term demand

The healthcare sector blends structural demand (aging populations, chronic illness care) with innovation (biotechnology, medical devices, precision medicine). It’s a unique mix of stability plus growth potential.

Zero-Commission Trading

Claim Free Stocks on Webull

Open a Webull account and make your first deposit to unlock bonus stocks. Powerful charts, extended hours, and a sleek app—great for active or casual investors.

Affiliate link, disclosures apply.

Example company: Johnson & Johnson (JNJ)

In 2024, J&J reported revenue of $88.82 billion, up 4.3% year-over-year (StockAnalysis). Over the past five years, J&J’s stock performance is reported at ~29.3% gain (SimplyWallSt). The company also boasts more than 60 consecutive years of dividend increases (Investor Relations).

Performance evaluation: Johnson & Johnson may not match tech’s explosive gains, but it offers a compelling mix of resilience and dividend longevity. That durability can appeal to investors looking for a foundation beyond the high-octane tech space.

Sleeper pick: DaVita (DVA)

Why it’s interesting: Niche provider in dialysis with scale advantages; capital returns via buybacks can boost per-share metrics.

Recent snapshot: Q3 2025 revenues were $3.42 billion and free cash flow was $604 million (DaVita press-release) (turn0search4). Considerations: Reimbursement dynamics and clinic operations can drive swings; stock has shown both strong multi-year returns and near-term volatility.

🛒 3. Consumer Staples — essentials that never go out of style

Consumer staples include everyday goods—food, beverages, household supplies, hygiene items. Because people continue to buy these items in good times and bad, the sector is often viewed as a defensive stronghold in portfolios.

Example company: Procter & Gamble Company (PG)

For fiscal year 2025, P&G reported net sales of 0% (flat), but organic sales up +2% and diluted EPS up +8% (BusinessWire). Over the long-term, the company has delivered average annual returns of ~8.38% over the past 20 years (FinanceCharts).

Performance evaluation: While P&G isn’t a high-flyer, it emphasizes capital discipline, brand strength, and dividend stability. For investors seeking less volatility and consistent cash flows, staples like PG can be an anchor.

Sleeper pick: BellRing Brands (BRBR)

Why it’s interesting: Protein drinks/bars (Premier Protein) in a growth sub-category of staples; still smaller than mega-cap staples.

Recent snapshot: Q3 FY2025 net sales of $547.5 million and adjusted EBITDA outlook of $480-$490 million for FY2025 (BellRing press-release) (turn0search6). Considerations: Brand execution and input costs matter; valuation can be growth-like for a staples name.

⚙️ 4. Industrials — building the future, literally

Industrials span heavy equipment, logistics, aerospace, automation and infrastructure. As economies grow and rebuild, this sector often becomes the backbone of physical progress and productivity gains.

Automate Your First Step

Start Investing with Your Spare Change

Acorns rounds up your everyday purchases and invests the change automatically—perfect for getting started without overthinking it. Set it, build the habit, and let compounding work for you.

Affiliate link, disclosures apply.

Example company: Caterpillar Inc. (CAT)

In the third quarter of 2025, Caterpillar posted sales and revenues of $17.6 billion, a 10% increase compared with the same quarter in 2024 (Caterpillar press-release). The adjusted EPS for the quarter was $4.95, a modest decline from the $5.17 in Q3 2024. Analysts noted CAT’s stock surged roughly 21% in a single month during October 2025, largely linked to positive sentiment and global expansion (Forbes).

Performance evaluation: CAT illustrates both opportunity and risk: strong growth in infrastructure demand, yet sensitive to commodity costs, supply-chain disruptions, and economic cycles. For investors seeking to participate in real-world growth engines, industrials represent an important link beyond tech.

Sleeper pick: Dycom Industries (DY)

Why it’s interesting: Specialty contractor for telecom/fiber builds; levered to ongoing network and data-infrastructure investment.

Recent snapshot: Contract revenues were ~$1.085 billion in fiscal Q4 2025 (up ~13.9%) (Dycom press-release) (turn0search11). Considerations: Project timing/backlog can swing earnings; customer concentration is a watch-item.

Putting it all together

Including these sectors doesn’t mean “give up tech” — instead, it means acknowledging that tech is one piece of a much larger economic puzzle. A well-rounded portfolio often blends growth, income, and stability across sectors.

Here’s a simple way to view it:

- Core first: Start with a broad market fund (total-market or S&P 500) that gives foundational exposure.

- Satellite sectors: Add modest exposure to Energy, Healthcare, Consumer Staples, and Industrials to diversify your portfolio’s engines of return.

- Cost and simplicity: Keep expense ratios low, avoid over-complicating, and maintain a long-term mindset.

- Rebalance occasionally: Let time and discipline maintain your allocations rather than chasing every trend.

In the end, the goal is not to pick “the next big thing” but to build something resilient. While tech continues to innovate, real-world sectors like energy, health, staples and industrials keep economies humming—and portfolios balanced.

By broadening your view beyond chips and code, you may find opportunity in places others overlook, while also guarding against being too heavily exposed to one theme or market mood.